Property investment and lease management

Objective

- Sustainable long-term financial structure

Key performance indicator |

2013–14 target |

2013–14 achievement |

|---|---|---|

| Lessors satisfied with overall customer service | 90% |

97% |

Major outcomes

Overview

Revenue generated from the sale and lease back of properties continues to be DHA's primary source of capital. Direct leasing from private owners and negotiation with lessors to renew or extend leases and undertake upgrades help to ensure that quality, well-located properties are available to Defence members and investors.

At 30 June 2014, 69% of the portfolio was managed on behalf of investors. Lessor satisfaction with almost all aspects of leasing and customer service remained consistently high (86% to 97%). Combined with positive capital and rental growth, this contributed to an increase in repeat purchases and referrals year-on-year.

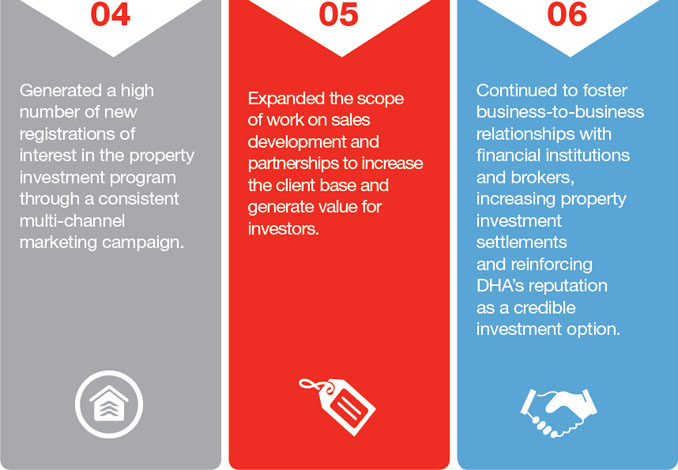

During 2013–14, efforts focussed on delivering against KPIs while establishing new channels and products. Fostering of relationships and partnerships continued as well as action to increase awareness of the DHA brand. These activities helped confirm DHA's reputation in the industry as a credible investment option.

As part of a brand audit in 2013–14, research was conducted to measure brand awareness. Results showed that 62% of members of the general public had recognition of the brand with 61% of respondents being able to correctly describe services provided.

DHA's competitive advantage

Others have attempted to emulate the DHA property investment program. However, the GBE status, Services Agreement with Defence, the security of Defence members as tenants, the standard of property delivered in accordance with Defence guidelines and the diversification of supply offered Australia-wide mean there is no comparable organisation within the property industry.

Property investment program

Each year properties are sold to investors under a leaseback arrangement. The properties have been built or acquired in locations where housing is needed for Defence members. They meet Defence requirements in terms of rent, size, amenity, inclusions, location and proximity to Defence establishments.

Sales of properties to retail investors were strong during the year, reflecting favourable market conditions supported by low interest rates and high levels of investor confidence.

DHA settled sales on 729 properties in 2013–14, generating $386.4 million in revenue against the Corporate Plan figure of $379.6 million. Profit was $22.7 million. Repeat purchases and referrals from existing lessors fell slighlty to 22.1% of settlements in 2013–14, compared with 24.0% of settlements in 2012–13.

Lease Agreement

Distinguishing features of the Lease Agreement provided to investors under the property investment program are:

- a long-term lease (typically between nine and 12 years; greater when lease extensions are exercised)

- guaranteed rental income during the lease term, with rent payable from settlement and no loss of income when Defence tenants change1

- DHA Property Care services2 provided during the lease term, comprising:

- property and tenancy management, including periodic inspections, itemised statements and a complimentary bill paying service

- organising and covering the cost of most non-structural maintenance, including the repair and replacement of fixed appliances as required

- annual rent review to market valuation by an independent licensed valuer

- emergency repair to preserve the property and protect human health, safety and security as required

- restoration at lease-end to ensure the property is returned in good order, including professional cleaning, repainting and recarpeting.3

1 Rent subject to abatement in limited circumstances.

2 DHA Property Care services are provided during the term in return for a fixed service fee.

3 Subject to the length of the lease and the obligations of a Body Corporate or similar entity.

Unlisted Property Fund

DHA IML is a solely-owned subsidiary of DHA and is the manager and responsible entity for the DHA Residential Property Fund No. 1 (Fund).

In late 2013, 47.1 million one-dollar units were issued, raising $47.1 million. These funds were used to purchase a geographically diversified portfolio of 79 DHA properties valued at $44.4 million under a sale and leaseback transaction.

Quarterly distributions attributable to unit holders for the reporting period totalled $1,186,920 ($0.0084 cents per unit). The value of the properties in the Fund, independently determined by registered valuers, increased by 4.3% during the reporting period.