Feb 6, 2019, 16:03

by

Rachael Whiteley-Black

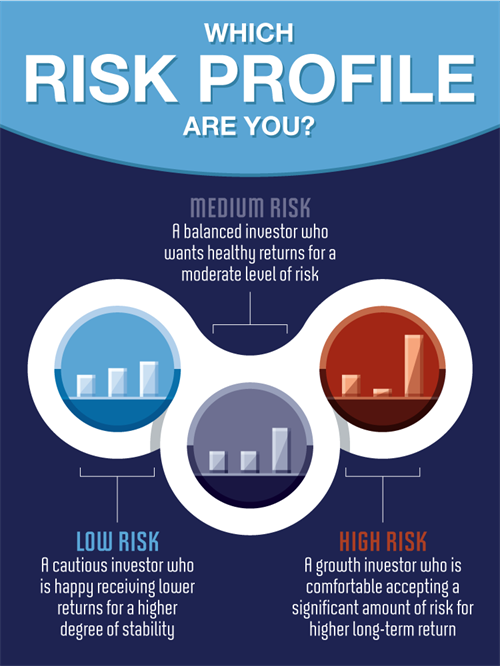

Investors largely fall into three distinct categories of risk tolerance. We explore each profile – and offer a few investment ideas.

Understanding your risk profile is critical when deciding on the property investment that’s right for you.

Understanding your risk profile is critical when deciding on the property investment that’s right for you.

Everyone’s appetite for risk is different and it depends on numerous factors including your age, income and financial goals.

It’s important to determine your risk profile before embarking on an investment strategy and to update it as you age and/or your circumstances change.

So, what’s your risk capacity? The Australian Securities and Investments Commission defines risk tolerance as “the degree of uncertainty you are prepared to accept in relation to investment returns”.

Major life events such as job promotions, the arrival of a baby or imminent retirement are likely to alter your tolerance for risk. It may also depend on how comfortable you are with your level of investment, says financial planner Michael Miller.

'Ask yourself if you’re going to lose sleep if your investment is down 10 per cent over three months,' he says. 'It’s something that has become much more realistic for people in the past few months where share markets in Australia and overseas have fallen after an extended period of constant good returns. As well, some property markets have had strong run-ups but then over the past six or 12 months have experienced some falls as well.

'So it’s about how much you can cope with before you get too nervous.'

Your risk appetite may also be strongly influenced by the nature of your goals. Miller says someone who is hoping their return will fund an overseas holiday is likely to have a higher risk tolerance than someone who is investing to fund a house deposit.

Which risk category do you fit into?

Low risk

Conservative investors like to play it safe. They take minimum risks, so their portfolio may not see many windfalls, but they make steady returns. Essentially, they are less exposed to market fluctuations than other investors.

Risk-averse investors may be retirees who don’t have the luxury of long-term investments, or families who may be on one income.

Medium risk

These investors can tolerate a moderate level of risk. They make balanced investments to get the best of both worlds.

By reducing risks and enhancing returns in equal measure, the medium-risk investor uses a balanced approach to make healthy returns. While they are more exposed to market downturns than low-risk investors, they stand to make more during market peaks.

Many investors, including those with considerable experience, are in this category. Their investments still have the potential for growth but they don’t find themselves lying awake at night when markets fluctuate.

High risk

These investors have the time and/or cash reserves to weather short-term fluctuations in pursuit of higher long-term returns. High-risk investors are willing to expose a substantial portion of their investment to volatility.

These investors may be high-income earners, young professionals or seasoned, middle-aged investors.

With at least a 10-year view, they play a long game. To take full advantage of this approach, high-risk investors avoid pulling their money out at the wrong time.

For more information on risk tolerance, visit ASIC’s MoneySmart website or seek advice from a professional financial advisor.

The advice contained in this article is for general information only and should not be taken as financial advice. Investment is subject to DHA’s lease terms and conditions of sale. Investors retain some responsibilities and risks including property market fluctuations. Prospective investors should seek independent advice.