Purpose 4

Meet agreed shareholder financial requirements, while continuing to operate commercially, efficiently and sustainably

- Criterion 1: Provide financial returns to our owners, ensuring that business operations are commercial and efficient

- Criterion 2: Maintain a sustainable financial position

Overview

We are committed to meeting shareholder financial requirements and to operate commercially and efficiently as a GBE.

Detailed commentary

Our performance against stated measures and objectives in our Corporate Plan 2015–16 was as follows:

Criterion

Provide financial returns to our owners, ensuring that business operations are commercial and efficient.

Result

Achieved

Overall, our financial year results were better than the Corporate Plan targets. For the year ended 30 June 2016, EBIT was $158.2 million or $7.2 million above the target and NPAT was $104.6 million or $4.3 million above the target.

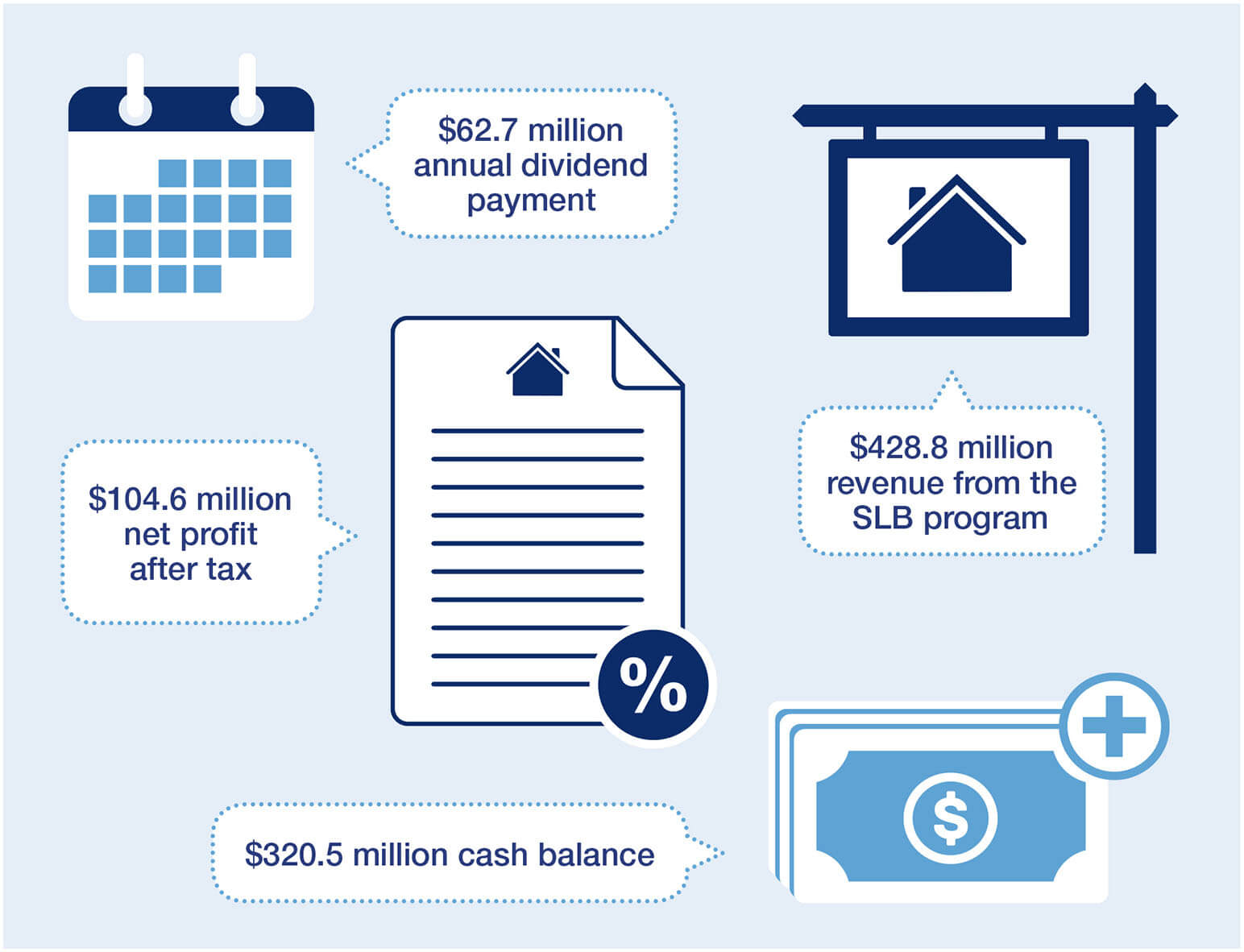

Returns to government

In accordance with the GBE guidelines, we pay an annual dividend to the Australian Government. Based on 60 per cent of NPAT, the final dividend payment will be $62.7 million (paid on a quarterly basis throughout 2016–17), which is $2.5 million above the Corporate Plan target. Figure 15 shows our NPAT and dividend payments over the last five years.

Figure 15: NPAT and annual dividend payments, 2011–12 to 2015–16

We also monitor total shareholder return which measures the total return to our shareholders arising from dividends, as well as the growth in the value of the business. We improved our performance from 7.9 per cent in 2014–15 to 8.9 per cent in 2015–16, against a target of 8.1 per cent.

Generating revenue

As we do not receive funding from the federal budget, we seek to generate sufficient revenue to enable us to achieve our mandated role on a commercially sustainable basis.

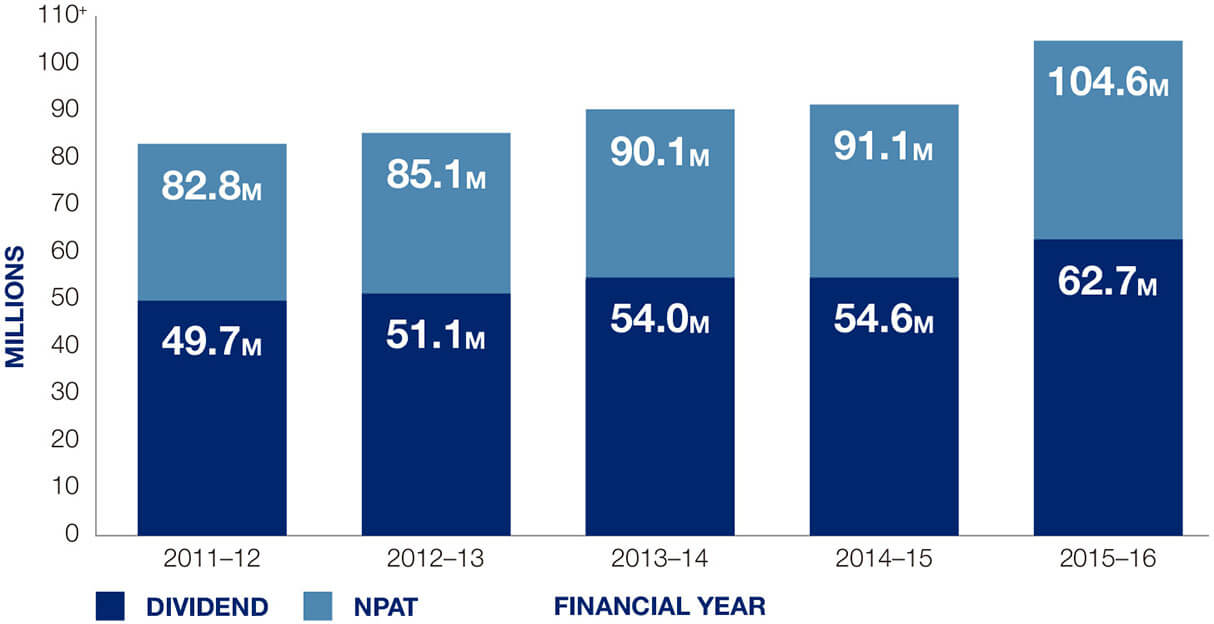

Apart from payments we received for the housing services we deliver to Defence, our major source of revenue continues to be our SLB program whereby we sell our properties to investors on long-term lease back arrangements.

As demonstrated in Figure 16, the SLB program has historically performed well, generating almost $2 billion in revenue over the last five years, and proven to be a reliable funding source in varying market conditions.

Figure 16: Revenue generated from the SLB program, 2011–12 to 2015–16

Sales and Leaseback (SLB) program

The SLB program settled 787 properties for the year ended 30 June 2016 generating $428.8 million in revenue. While this achievement was below our Corporate Plan target of $520.8 million, it was considered to be a good performance given difficult property market conditions.

Residential investment activity was impacted by the Australian Prudential Regulatory Authority's tightening of lending requirements for investors. This particularly impacted market conditions in Sydney (NSW), Darwin (NT) and Perth (WA) and, consequently, our sales in these locations.

Our lessor, Guru, is grateful that property investment with DHA gives him and his wife, Neetha, the freedom to enjoy their time as new parents. Read more of our happy property investor stories.

Criterion

Maintain a sustainable financial position.

Result

Achieved

Capital management

As at 30 June 2016, we had a strong balance sheet. We employ total capital of almost $2.4 billion, which is funded primarily through $1.5 billion in equity and $509.6 million in debt. As our owner, the Australian Government contributes a debt facility of $634.0 million. This is facilitated through a loan arrangement with Finance and Defence. As at 30 June 2016, $509.6 million had been drawn down, leaving available headroom of $125.0 million, with maturities scheduled on a rolling basis over the next 10 years.

We do not have a commercial overdraft facility or access to re-drawable loan facilities. There were no new borrowings during the reporting period. As at 30 June 2016, gearing was 25.8 per cent and the financial results for the year provided interest cover of 7.0 times.

Our financial statements are presented in Section 4 of this report. The ANAO issued an unqualified audit opinion for these statements on 17 August 2016.

A summary of our five-year financial performance is also provided at Appendix E of this report.

Taxation

We fully comply with the Australian Government's income tax, GST and FBT legislation. We also comply with competitive neutrality policy ensuring we cannot gain a commercial advantage from tax exemptions flowing from our status as a GBE.

In accordance with this policy, we make tax equivalent payments in respect of state- and territory-based taxes (e.g. pay roll tax, land tax and stamp duty) that would apply if the exemption provision was not in the DHA Act. In 2015–16 our, state tax equivalent payment equates to $42.2 million.

Credit rating

Our commerciality is also demonstrated by our credit rating, which is assessed by Standard & Poor's Rating Services at least annually.

Their report issued on 17 December 2015 confirmed a corporate credit rating for DHA of AA+/Stable/A-1+. This is reflective of their assessment of the effect of government ownership and the level of support implied by that ownership.

Standard & Poor's also provided a stand-alone credit profile of DHA as BBB+. The stand-alone rating is one notch above the BBB target credit rating for GBEs specified in the GBE guidelines.

Analysis of performance against Purpose 4

Our financial returns are subject to the property market and the general economic environment. They are largely impacted by rental yields, sales prices and development margins. These are not within our control, however, we have the ability to vary or scale programs to respond to changing conditions.

Many of the major recommendations from the Forensic Review focused on the management and funding of our programs, which directly impact our financial sustainability, commerciality and risk profile. Subsequently, one of the major outcomes was the creation of more sophisticated financial modelling which has enabled us to undertake more comprehensive scenario and sensitivity analysis. It has also allowed us to share this information and communicate more transparently with our shareholders.

We have previously explored alternative funding structures to reduce our reliance on the SLB program and pursued bulk sales and a real estate trust. The Forensic Review reiterated the importance of these activities to maintaining the sustainability and commerciality of our operations, and recommended an exploration of real estate trusts and other funding structures that may allow us to retain or regain housing stock over the longer term.

We will also evaluate the potential for joint development arrangements or other funding options in relation to development projects where appropriate. Joint venture or similar arrangements may provide opportunities for us to source properties in partnership with the private sector while sharing the risk and funding requirements associated with development activities.