Property prices are falling and the economic outlook is weak. On top of that, regulators and the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry have been scrutinising lending practices. These factors combined have made lenders cautious about approving loan applications.

'Lending criteria have tightened across the board, which means it is more difficult to secure any type of home loan product than it was as recently as 18 months ago,' Mortgage Choice chief executive Susan Mitchell says.

New lending to households was down 18.6 per cent in February 2019 compared with the same time the previous year, Australian Bureau of Statistics data shows. Lower demand accounted for some of this decrease but higher barriers to securing finance have also taken a toll.

Lenders are closely examining borrowers’ expenditure patterns, meaning loans are taking longer to process – if they are approved at all.

But there are strategies borrowers can use to improve their chances of getting loan approval. Financial discipline are two words that are music to lenders’ ears.

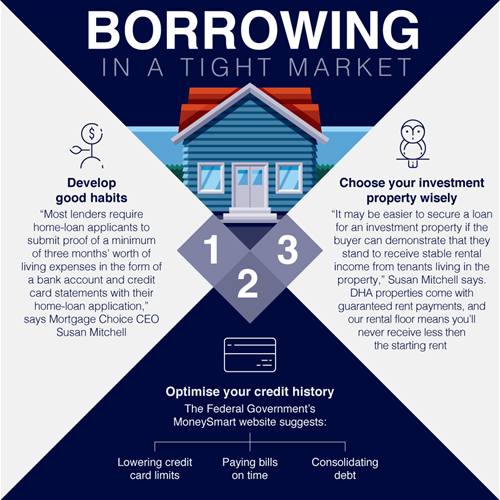

Develop good habits

Reviewing living expenses, cutting back on discretionary spending and avoiding unusual one-off costs before you apply will help.

'Most lenders require home-loan applicants to submit proof of a minimum of three months’ worth of living expenses in the form of a bank account and credit card statements with their home loan application,' Mitchell says.

Lenders are closely assessing spending across about a dozen categories, from groceries to entertainment. In the past, they trusted borrowers would cut back after their loan had been approved. Now, they expect applicants to exercise restraint upfront.

Clean credit slate

A clear credit history will reassure lenders that you’ll make repayments as required.

Simple steps such as lowering credit card limits, paying bills on time and consolidating debt can optimise your credit history, the Australian Securities and Investments Commission’s MoneySmart website suggests.

If you’ve had credit problems in the past, the expansion of the Comprehensive Credit Reporting (CRR) system from July 1, 2019 could be a blessing.

Since July 1, 2018, lenders have had access to comprehensive reports on consumers’ credit histories; however, the scope of what was available to them was limited. From July 1, 2019, lenders will have access to more data, including repayment history information.

According to Canstar, people with a “thin” credit file or a short credit history should have more details in their file concerning their credit-worthiness, which may make it easier for banks to lend to them.

Reassuring rentals

Lenders will consider the investment risk of a rental property. 'It may be easier to secure a loan for an investment property if the buyer can demonstrate that they stand to receive stable rental income from tenants living in the property,' Susan Mitchell says.

Investment properties rarely come with rent payments guaranteed. Defence Housing Australia properties are one exception. DHA properties are typically sold on a 12-year lease with three-year options to extend. Rents are reset annually to market rates and there is a rental floor, which means investors will never receive less than the starting rent – even if market rates fall below it.

In general, areas where tenant demand is strong and vacancy rates are low will be most likely to produce stable rental incomes.

In Canberra, for example, rental vacancy rates are low and annual growth in rents has been the strongest of any of the capital cities, according to the Domain Rental Report for the first quarter of 2019.

Vacancy rates in Adelaide are tightening, too, with fewer rental properties available and steady migration levels, the Domain report reveals.

Borrowers who can show lenders they have financial discipline, a good track record and a low-risk investment property will be the most likely to receive loan approval.

Disclaimer: Investment is subject to DHA’s lease terms and conditions of sale. Investors retain some responsibilities and risks, i.e. rent, restoration and market fluctuations. Prospective investors should seek independent advice. See dha.gov.au/lookforward for relevant information.